property tax in france 2020

Exactly how much CFE you can claim back will depend on the. How much are taxes in France.

Own A Holiday Home In France This Ultimate Tax Guide Is For You

So if youre selling a property in France you could end up paying a rather hefty 362 in plus values on any profits you make.

. More households will be exempt from the taxe dhabitation this year as the gradual abolition of the tax continues. If you are renting out a French property the net income will be taxed at the scale rates of income tax ranging from 11 for income over 10084 to 45 income over 158122 in 2021 plus 172 social charges. There are various tax regimes for French.

Any person living abroad and owner of real estate in France is subject to French property tax. French property tax for dummies. 108 rows It is going to be much the same for 2020.

How to file a tax return in France. If you own a property in France you will be subject to two different local french taxes. For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise.

The level of the tax last. You have to pay this tax if you own a property and live in it yourself have it available for your use or rent it out on. Then you will benefit from a reduction of 30 in 2018 65 in 2019 and complete abolition by 2020.

There is no exemption. Together the two. Tuesday 10 November 2020.

When purchasing a property more than five years old there are three separate taxes payable with a maximum tax payable of just under 9 per cent. For property tax on the earnings from the sale of properties in France rates are set to 19 for all EU citizens and 3333 otherwise. The 75 limitation also remains unchanged.

The budget did not include any reforms for Succession Tax rates and allowances. In total these taxes amount to just over 20 per cent of the value of the property see Buying a new build in France. As a French property owner you must pay these French property taxes whether you are a permanent resident or use the property as a second home or holiday home.

Non-residents are subject to a flat rate of 20 or 30 on net taxable income in France. The tax typically amounts to between 100 1500. The rate is 509 580 for real estate located in France variable according to where it is located and 5 for real.

The two property taxes in France are the taxe foncière and the taxe dhabitation although the latter is gradually being phased out by 2020 for most households. In France there are two main property taxes payable for new build purchases. Taxe dhabitation is a residence tax.

French income tax. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary residence. Maintenance property taxes in France - what do I need to know.

The declaration is made from April and the tax notice is received at the end of the summer of the current year. Note that the proposed measures dont apply to second home owners in France. Now that youve paid your notaires fees and other one-off sales taxes theres another category of French property tax to get to grips with as a buyer.

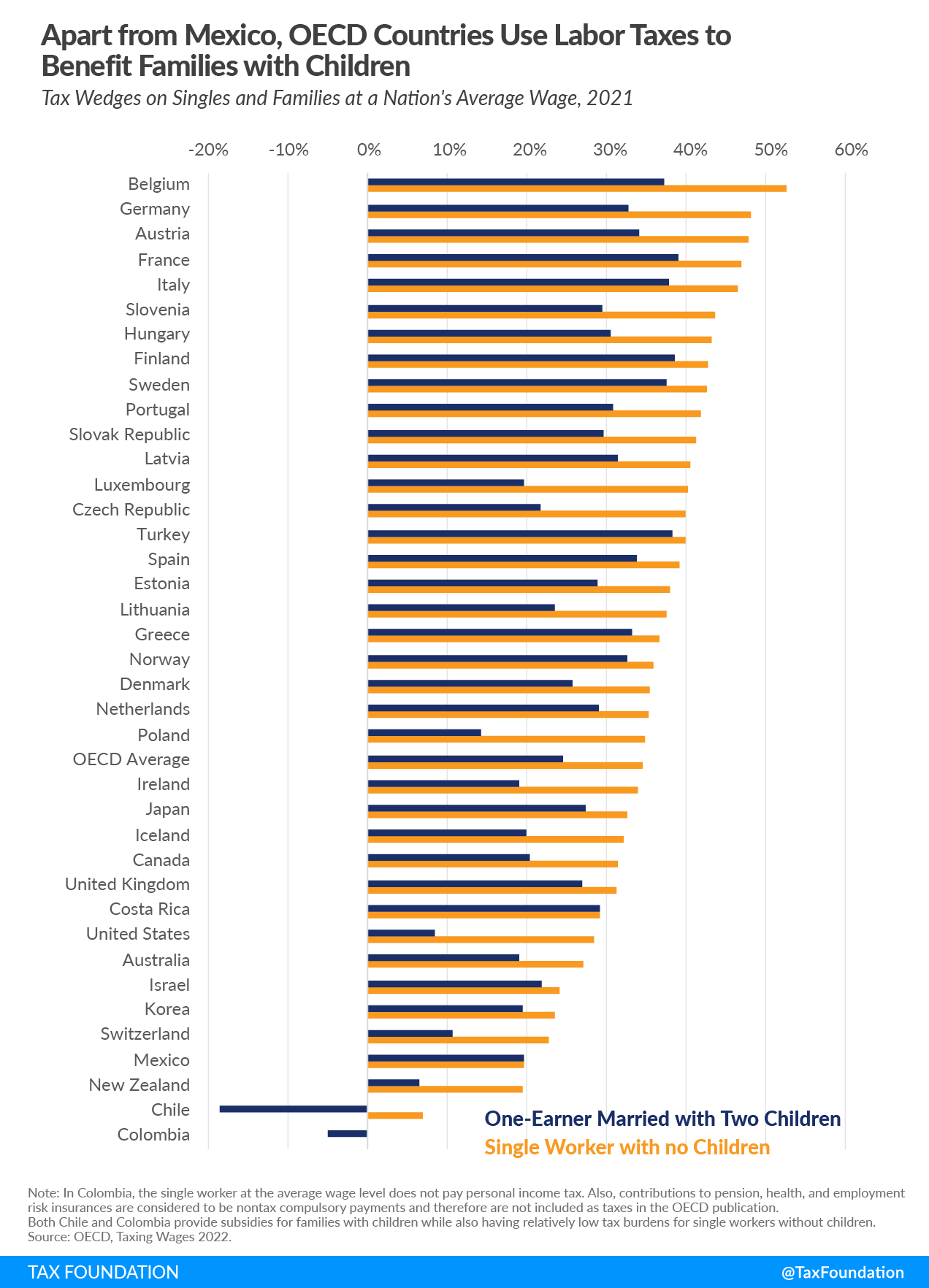

The good news is that many property owners pay too much CFE and are entitled to a refund. Todays map shows how European OECD countries rank on property taxes continuing our series on the component rankings of our 2020 International Tax Competitiveness Index Although an important element when measuring the neutrality and competitiveness of a countrys tax code property taxes account on average for less than 5 percent of total tax. Married residents with income over 500000 EUR are subject to a surtax of 3.

The total taxes and fees will depend on the type of property you decide to purchase. The basis of tax is the price if the real estate is transferred against payment and the market value in other cases. The same applies to French residents who rent out property abroad.

Frances taxation primarily revolves around family units and a married couple will be required to file a joint tax return. Here is how it is calculated. Over the past two years there have been progressive reductions of 30 and then 65 in the tax for households within eligible income thresholds.

Exemption Thresholds 2021 2020 Income In practice only 44. This year that exemption increases to 100 for households whose net. Residence tax or occupiers tax - Taxe dHabitation.

Income Tax Rates and Thresholds Annual Tax Rate. When it comes to completing a French tax return the process depends on how whether it is your first time or not. France Non-Residents Income Tax Tables in 2020.

The housing tax and the property tax. There are two local property taxes in France payable by both residents and non-residents. Real Estate Wealth tax and Succession Tax in France.

As the table above illustrates this means in simple terms that the maximum personal income tax rate in France in 2020 is 49 45 4. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. CFE is an annual tax which is paid by owners of furnished properties in France based on the theoretical rental value of their property.

Any owner of real estate in France on 1 st January of the taxation year must pay the property tax during the last quarter of the same year after receipt of his tax. Married residents with income over 1000000 EUR are subject to a surtax of 4. French notary fees are varying from 5 for the first 3000 and then gradually down to 03 if your purchase exceeds 120000.

Lets say that you purchase an old property. The current threshold of 1300000 for the IFI real estate wealth tax will stay in place for 2020 with no changes to the scale rates of tax.

Visualize The Entire World S Wealth Inequality Inequality Developing Country Data Visualization

Taxe D Habitation French Residence Tax

France Tax Income Taxes In France Tax Foundation

Pin On What I Read This Month August 2020

France Tax Income Taxes In France Tax Foundation

French Property Tax Considerations Blevins Franks

Taxes In France In 2021 All You Need To Know

France Tax Income Taxes In France Tax Foundation

Pin By Jim On Me Me Me Self Help John Clark Extreme

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Map Activities

Taxes In France A Complete Guide For Expats Expatica

French Taxes I Buy A Property In France What Taxes Should I Pay

Feature Your Property At Europe S Premier Real Estate Event Exp Commercial Brokerage Real Estate Commercial Real Estate Real Estate Sales

Why You Should Buy A House In France In 2022

Pin By Pauline Straker On France House Move Moving House Agree Helpful

Crypto News From Japan Jan 13 17 In Review Security Token Cryptocurrency Trading Chinese News